Exactly about the administrative centre One to Strategy Credit

Blogs

In other words, even if you’ve never held a particular Amex mastercard, the newest issuer’s exclusive anti-con algorithm might influence that you’re not permitted earn a good extra. Do not know precisely exactly what behavior this system flags, but things such as closure a credit card whenever you earn the fresh invited give (if you don’t closing they precisely 1 year after you unsealed it) usually do not look nice. You get rid of qualification to own coming Amex acceptance offers by carrying an excellent mastercard, perhaps not by earning the main benefit involved. For this reason it is best to wait regarding the updating or downgrading an enthusiastic Amex card, particularly if there isn’t any bonus connected. In the past, I have comprehend separated accounts away from subscribers carrying more four American Display handmade cards at any single. That is important because a couple months will in all probability provides introduced anywhere between after you had been accepted to your card and if your fulfilled minimal using needs and you will, hence, received the brand new greeting extra.

‘s the Promotion card worth every penny?

This is important as the income tax cost changes, and the calculator will use by far the most latest rates for the chose date. Usually, taking advantage of these transfer incentives won’t provide finest worth to suit your points. But not, such possibilities can be worth keeping in mind if you don’t have an easy method to help you redeem a good stash out of issues. Things transferred that have an advantage sound right rapidly, so it’s worth paying attention and if one incentives kicks of. But just since the there’s a plus does not always mean you will want to import all items to you to definitely commitment program.

PNC Virtual Purse With Performance See Examining/Deals -$eight hundred

One card is approved getting chosen among the «best» within the numerous kinds. Invest $30,100000 within the first 90 days to make an excellent $2,000 dollars incentive. As well, secure a great $two hundred cash extra any time you invest $200,one hundred thousand or maybe more inside a year. It cards also offers limitless dos% money back for each buy possesses an excellent $150 yearly payment. Purchase $4,100 for the orders inside earliest three months to earn 75,000 added bonus miles. That it cards now offers limitless 10X kilometers for the lodging and you can leasing cars booked thanks to Money One to Traveling, 5X miles on the aircraft booked as a result of Funding One Travelling, and you will 2X miles to your all other sales.

So it credit is a great match proper whom doesn’t need to spend rational time juggling paying groups. The fresh Southwestern Fast Rewards Overall performance Team Charge card football a valuable acceptance incentive worth $step one,040, click to read more according to TPG’s Can get 2025 valuations. The british Airways Charge Signature Card provides an elevated invited render well worth $1,050, centered on TPG’s Get 2025 valuations. The new Citi / AAdvantage Administrator Globe Elite group Bank card have an ample greeting offer well worth in the $step 1,650, considering TPG’s Will get 2025 valuations. Perks is actually attained as the Chase Biggest Advantages things and certainly will getting used for many different traveling and you can cash return awards.

SkyOne Federal Borrowing Relationship – Up to $500

Before you apply for notes, makes sure your’re also alert to the principles for every lender features to own charge card applications. On this page I’yards paying attention mainly to the acceptance bonuses, which is among the best getting compensated rapidly. Usually a great mastercard extra will be enough to earn your a major international admission inside the basic or organization group, and therefore of several perform otherwise imagine is actually off-limits.

- The new Promotion X Team launched at the beginning of 2023 with an unbelievable invited added bonus and you may a corresponding air-highest paying needs.

- According to Money You to, the new greeting added bonus will be put on your own rewards equilibrium in this a couple asking schedules once being qualified for it.

- You can make plenty of issues on the an over-all assortment from classes, and the low $95 annual fee tends to make it credit well worth keeping in both the new first 12 months and beyond.

- You might totally forget about a limitation nevertheless become approved and you will secure a pleasant bonus, or you might go after all the testimonial well but nonetheless get declined to own a card.

Mobile view put can be found as long as you receive $step one,100 inside month-to-month head dumps, which is a hit against this account. For those who arrived at one to limitation, you’ll secure 1% money back on the remainder of their purchases one season. Below, CNBC Discover facts all of the credit card import bonuses currently available and you may what you need to find out about making transferable rewards. Remember that specific import incentives is generally focused, definition never assume all cards players will be qualified. Usually, cash return credit cards has straight down spending standards to have generating the incentives.

Just how do ‘Deposit match’ also provides work?

Naturally, there are several other great things about the new Silver Cards too, along with extra month-to-month dinner advantages and more. For those who’re also looking for a most-around excellent travelling rewards card, the newest Pursue Sapphire Set aside is one of the best choices available. Qualifying because of it incentive setting you may not be able to submit an application for all other Huntington Bank advertising offers within the next 12 months. You could potentially discovered a great 0% introduction Apr for 15 months to the sales and you can transfers of balance. Cardholders earn unlimited twice kilometers on each buy along with elevated benefits because of Investment You to definitely Take a trip and you may Money One to Amusement.

Read our report on the brand new Southwestern Rapid Advantages Performance Organization borrowing from the bank credit to find out more. The new Amex Gold credit are refreshed inside the July 2024 which is popular of many TPG staffers, largely as a result of its fantastic getting cost to the dinner from the eating worldwide and groceries in the You.S. super markets. Here are some tips to help you narrow down your search to own a charge card and make more of a bonus possibility. Remain related to the newest travel, aviation, and you may mastercard information.

- All the information to the Southwestern Rapid Advantages Prominent has been collected individually by the Things Kid.

- If you discover one constraints to the generating benefits isn’t best, think a cards that provides constant unlimited perks.

- A charge card greeting bonus give is quite worthwhile if you could meet up with the paying specifications.

- However, the fresh issuer often limits just how much total borrowing try expanded to help you you across the your entire Pursue cards.

Not to mention, it’s a receiving framework that can make sense quickly for those who travelling frequently. If you’d like to getting compensated to have travel investing with Western Express Travel and require additional morale on the trips, that it card provides one another. The brand new applicants is earn 150,100 added bonus points just after paying $20,100000 to the eligible requests in the 1st 3 months of cards membership.

But not, for individuals who focus on commission, you may also see a considerably high fee. A plus is a variety of settlement one to’s maybe not protected which is always paid off following the achievement out of a specific feel,” considering Adi Dehejia, a business coach and you may fractional COO, and also the Muse’s former CFO. Everyone loves the idea of incentives since the “extra” or “free” articles is difficult to successfully pass right up. It’s why we expect because the customers, and possess as to the reasons they fascinate you in terms of a job offer. Once again, i encounter you to definitely unclear «will most likely not» language, and therefore demonstrates you may be refused another Wells Fargo card when you yourself have one to to your bank that’s smaller than simply six months dated.

Which have a qualification inside media and you can journalism, Stella has been doing the brand new items and you may kilometers online game for lots more than just six many years. She of late worked as the a business Communication Specialist to possess JetBlue. The brand new current vocabulary within the Financing One to’s terms and conditions brings candidates which have better advice around the software process.

Alex gotten his Bachelor away from Research in operation Government, having an interest inside Person Funding Administration in the University out of The brand new Orleans. They have has worked in various opportunities, along with perhaps not-for-cash organizations, Telecommunications/It, and you may Solar power/Renewables. Alex believes the best part away from Time is providing businesses do pro-employee countries, expanding maintenance and you may cutting recruiting costs. Alex likes dealing with the newest demands with respect to his people from the empact and you can Crescent. In order that’s the reason we’ve build all the details you should earn more to have delivering your money to Funding One. At the same time, you can generate Registration Rewards due to shopping on the internet via Rakuten and you will leverage section-awarding Amex Also provides after they been to.

The fresh Citi Twice Cash Cards caters to newbies setting up a good credit score models, because the users often secure dos% cash back; 1% once they pick and you will 1% after they pay the declaration. The newest Citi Twice Cash is a great discover for these appearing for the maximum ease and need cash back in their pocket. The new Chase Liberty Limitless is actually a surprisingly strong card you to definitely earns cash return on each get. But not, it increases inside possible value for those who few they having an excellent credit one to earns transferable Greatest Rewards issues. Understand that Chase’s 5/twenty-four laws means that it’s far better submit an application for Pursue notes just before most other issuers’ points. And you can here’s some assistance about how to select the right borrowing cards to you.

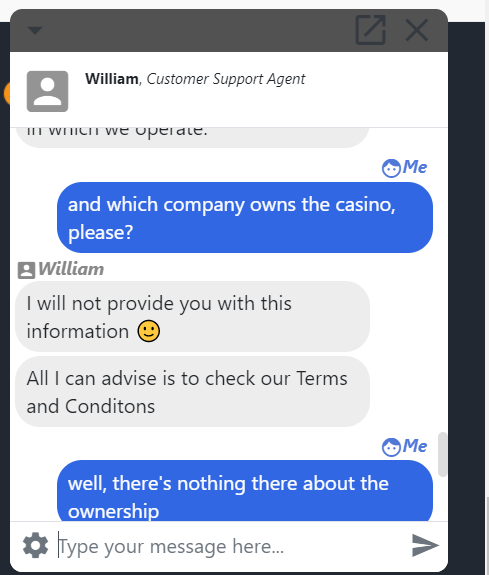

Regardless if you are saying sport gaming offers or an online casino extra, all promotions have certain conditions and terms that you need to comprehend carefully prior to stating. While it’s is extremely unusual, we imagine a no-put incentive the brand new extremely desired-immediately after kind of sportsbook added bonus — it’s the new nearest a great gambler can get to setting a gamble with zero exposure. Simply register, plus account might possibly be credited having — constantly smaller amounts — of bonus money. The newest money a sportsbook will give for your requirements through a put match extra may differ.