The Ultimate Guide to Forex Trading Signals

Forex trading signals are an essential aspect of successful trading in the foreign exchange market. They offer valuable insights and recommendations based on technical or fundamental analysis, making it easier for traders to make informed decisions. Whether you are a beginner or an experienced trader, understanding how forex trading signals work is crucial for optimizing your trading strategy. In this guide, we will delve into the fundamentals of forex trading signals, how to use them effectively, and explore some of the best resources available, including the renowned forex trading signals Trading Platform TH.

What Are Forex Trading Signals?

Forex trading signals are indicators or pointers that help traders make decisions regarding buying or selling currency pairs. These signals can be generated by professional analysts, automated systems, or trading algorithms. Typically, forex signals are accompanied by entry and exit points, risk management strategies, and suggestions on position sizing. They can be delivered through various mediums, including email, SMS, mobile applications, or through trading platforms.

Types of Forex Trading Signals

There are mainly two types of forex trading signals: manual and automated. Understanding the difference between these two categories will help you choose the best option for your trading style.

1. Manual Forex Trading Signals

Manual signals are typically generated by experienced traders or analysts who use their knowledge and intuition to identify trading opportunities. These signals require thorough market research, technical analysis, and an understanding of economic indicators. Traders who adopt manual trading signals often benefit from a more personalized and strategic approach, although it also demands more time and effort.

2. Automated Forex Trading Signals

Automated trading signals are generated by software or algorithms that analyze market data to identify potential trading opportunities. These signals are highly efficient and are capable of processing massive amounts of data in real time. Automated systems can eliminate human bias and fatigue, allowing traders to capitalize on opportunities quickly. However, it’s essential to use reputable automated systems as they can vary in accuracy and reliability.

How to Use Forex Trading Signals Effectively

Receiving forex trading signals is only the first step in successful trading. To maximize the benefits of these signals, traders must adopt effective strategies that incorporate risk management and disciplined trading practices.

1. Risk Management

One of the critical components of successful trading is effective risk management. Determine your risk tolerance level and use the signals to set appropriate stop-loss and take-profit levels. It’s advisable never to risk more than a small percentage of your trading capital on a single trade, ensuring you can sustain potential losses without significant damage to your account.

2. Follow a Trading Plan

A well-structured trading plan is essential for executing trades based on forex signals. Your trading plan should outline your goals, risk management guidelines, and the specific trading signals you intend to follow. Consistency and discipline are vital for implementing your trading strategy successfully.

3. Analyze the Market Context

While trading signals provide valuable insights, they should not be the sole basis for your trading decisions. It’s crucial to analyze the broader market context and confirm signals with additional technical or fundamental analysis. This multi-layered approach helps to validate the signals and reduces the risk of false alerts.

Where to Find Reliable Forex Trading Signals

In today’s digital age, numerous resources are available for traders seeking forex trading signals. However, not all sources are reliable. Here are a few channels where you can find trustworthy forex signals:

1. Trading Platforms

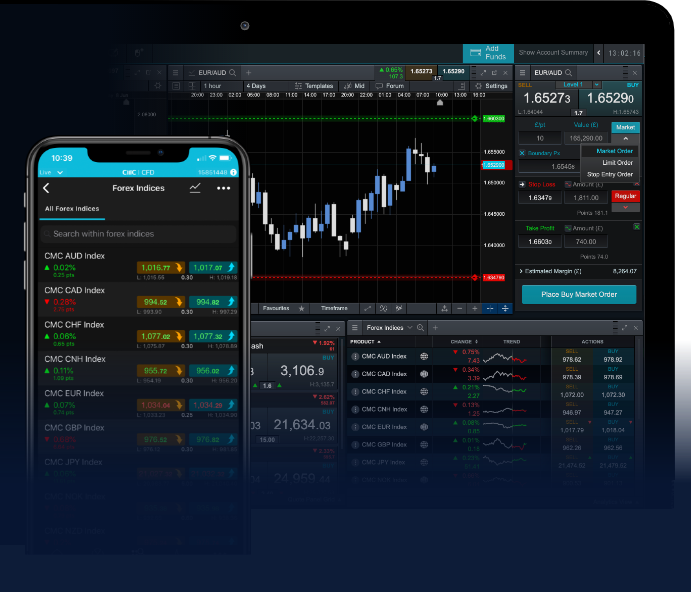

Many trading platforms integrate advanced tools and features that provide forex trading signals directly within their interface. Platforms like Trading Platform TH offer real-time signals derived from sophisticated analysis, making them a convenient option for traders.

2. Signal Providers

There are numerous signal providers, both free and subscription-based, that deliver forex signals through various channels. It’s essential to do your research and choose providers with good reputations and proven track records. Look for reviews, client testimonials, and the provider’s historical performance before committing.

3. Forex Trading Communities

Joining forex trading communities on platforms like social media, forums, or dedicated websites can provide access to insights, trading signals, and peer support. Engaging with other traders allows you to share experiences and strategies, boosting your overall trading knowledge.

Conclusion

Forex trading signals are valuable tools that can significantly enhance your trading experience. By understanding how these signals work and effectively applying them within a structured trading plan, you can increase your chances of success in the forex market. Remember to prioritize risk management and continuous learning, and consider utilizing resources like Trading Platform TH for optimal trading conditions. With the right approach and dedication, you can navigate the complexities of forex trading effectively and achieve your financial goals.