Understanding Forex Trading and the Foreign Exchange Market 1859583829

Understanding Forex Trading and the Foreign Exchange Market

The foreign exchange market, also known as forex or FX, is the largest financial market in the world, where currencies are traded. With an average daily trading volume exceeding $6 trillion, the forex market offers ample opportunities for traders. Visitors interested in beginning their forex journey can find useful resources and insights at forex trading foreign exchange market https://trading-asia.com/. This article will explore the fundamental concepts of forex trading, key terminology, market participants, trading strategies, and risk management techniques.

What is Forex Trading?

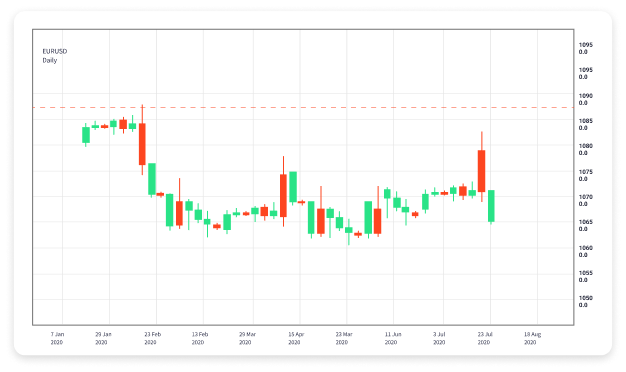

Forex trading is the act of buying one currency while simultaneously selling another. Transactions occur in currency pairs, where one currency is listed against another, such as the euro against the US dollar (EUR/USD). The price of a currency pair reflects how much of the second currency is needed to purchase one unit of the first currency.

The Basics of Currency Pairs

Currency pairs are categorized into three main types: major pairs, minor pairs, and exotic pairs. Major pairs include the most traded currencies, such as USD, EUR, JPY, and GBP. Minor pairs involve currencies of smaller economies and do not include the US dollar, like EUR/GBP or AUD/NZD. Exotic pairs consist of a major currency paired with a currency from an emerging economy, such as USD/TRY (US Dollar/Turkish Lira).

How the Forex Market Works

The forex market operates 24 hours a day, five days a week, encompassing three major trading sessions: the Asian, European, and North American sessions. Participants can trade at any time, making it a highly accessible market for individuals and institutions alike. Trading is conducted over-the-counter (OTC), meaning there is no centralized exchange, and transactions are facilitated through a network of banks, brokers, and financial institutions.

Forex Market Participants

The forex market consists of various participants, each with different motivations to trade. These include:

- Central Banks: Central banks regulate their respective currencies and monetary policy, influencing exchange rates.

- Commercial Banks: Large banks facilitate trades for clients and engage in speculative trading on behalf of themselves.

- Corporations: Companies involved in international trade use forex to hedge against currency fluctuations.

- Retail Traders: Individual traders who trade through online platforms, speculating on currency price movements.

Key Terminology in Forex Trading

Understanding key terminology is crucial for anyone looking to delve into forex trading. Here are some essential terms:

- Pip: The smallest price movement in a currency pair, typically the fourth decimal point (0.0001).

- Lot: A standardized quantity of currency units. A standard lot is 100,000 units.

- Leverage: A mechanism that allows traders to control larger positions with a smaller amount of capital.

- Spread: The difference between the bid price (what you can sell for) and the ask price (what you can buy for).

Trading Strategies

Forex trading strategies can vary widely, but they generally fall into two categories: fundamental analysis and technical analysis.

Fundamental Analysis

This approach focuses on economic indicators, geopolitical events, and overall market sentiment. Traders may analyze interest rates, inflation data, GDP growth, and employment figures to gauge the economic health of a country. Understanding how these factors impact currency demand can aid in predicting price movements.

Technical Analysis

Technical analysis relies on historical price data and charts to identify patterns and trends. Traders utilize various indicators, such as moving averages, RSI (Relative Strength Index), and Fibonacci retracement levels to make informed decisions. By studying price movements and market dynamics, traders aim to forecast future price trends.

Risk Management in Forex Trading

Risk management is a crucial aspect of forex trading. Successful traders employ several techniques to minimize potential losses:

- Setting Stop-Loss Orders: Automatically closing a trade when the price reaches a certain level to prevent excessive losses.

- Diversifying Trades: Avoiding putting all capital into a single trade or currency pair.

- Position Sizing: Determining the appropriate amount of capital to risk on each trade based on account size and risk tolerance.

Conclusion

The forex market provides vast opportunities for traders to profit from currency fluctuations. By understanding the basic principles of forex trading, familiarizing oneself with market terminology, and implementing effective trading strategies and risk management practices, individuals can navigate this dynamic market successfully. Always remember that thorough research, continuous learning, and disciplined trading can make the difference between success and failure in forex trading. For more resources and insights on trading, visit https://trading-asia.com/.